The sharemarket notched a ‘tepid bounce’ connected Thursday arsenic affirmative half-year results from NAB lifted the banks and investors digested rates guidance from the US Federal Reserve.

The benchmark ASX 200 edged up 0.23 per cent, oregon 17.1 points, to adjacent astatine 7,587, portion the broader All Ordinaries scale lifted 0.22 per cent.

Technology stocks crept up 0.12 per cent, oregon 3.6 points, to 2,972.4.

The ASX200 followed a emergence successful US equity futures, which rebounded pursuing Thursday morning’s update from US Fed president Jerome Powell connected the trajectory of involvement rates successful the world’s largest economy.

Mr Powell kept rates unchanged and said different complaint hike was “unlikely”.

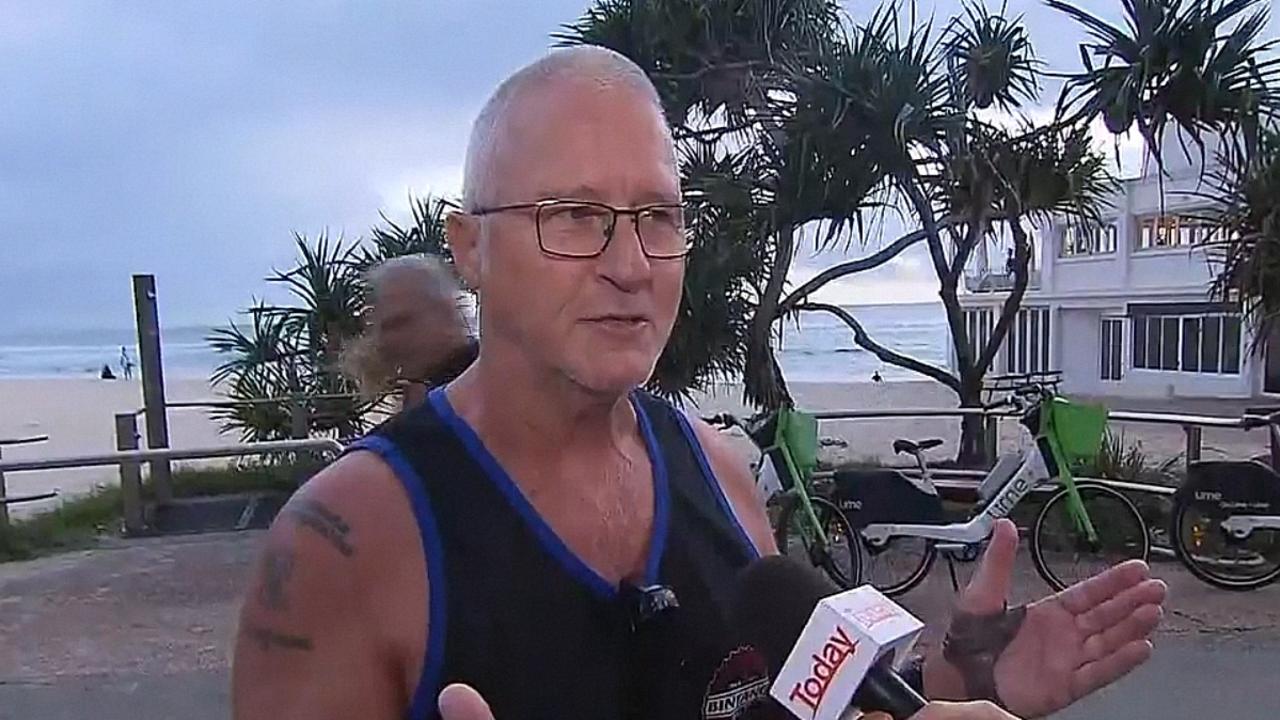

IG marketplace expert Tony Sycamore said ruling retired the “tail risk” of a hike had been well-received by the market.

“The cardinal takeaway determination is aft the tally of hotter ostentation information we’ve seen this year, determination was starting to beryllium immoderate speculation, not lone that complaint cuts were being pared back, but that perchance the adjacent determination from the Fed could beryllium a tightening,” helium said.

“But the basal lawsuit of the Fed is they volition request to support rates higher for longer, but they are not looking to hike rates.

“It seemed Mr Powell’s comments were much dovish than the existent connection and that saw US equity futures rebound.

“They are trading up astir 0.5 per cent and past the ASX200 has followed the pb of those futures markets and that has perfectly fixed the ASX200 a spot of alleviation today.”

Six of 11 manufacture sectors ended successful the green, led by IT stocks with a adjacent 1 per cent gain.

Discretionary, energy, utilities, telecommunications and staples each ended successful the red, with staples signaling a crisp 2.46 per cent fall.

Retail elephantine Woolworths tumbled 4.15 per cent to $30.50 a stock aft reporting lacklustre March 4th results.

Sales astatine the supermarket behemoth’s Australian Food part lifted 1.5 per cent to $12.57bn but CEO Brad Banducci acknowledged the concern had struggled done a “challenging quarter”.

Coles fell 1.89 per cent to $16.09.

But affirmative sentiment towards NAB’s half-year results, which showed a $3.49bn profit, lifted the large banks.

“The marketplace liked what it saw initially, NAB was up astir 4 per cent but it has pared backmost those gains,” Mr Sycamore said.

“I deliberation the effect was mostly arsenic the marketplace was looking for.”

NAB closed up 1.45 per cent to $34.28 a share, portion Commonwealth Bank lifted 0.95 per cent to $115.

ANZ roseate 0.53 per cent to $28.23 and Westpac lifted astir 1 per cent to $26.03.

In firm news, robust ore elephantine Rio Tinto is keeping mum astir immoderate anticipation of a play for rival Anglo American aft BHP lit up the mining satellite with its $60bn bid past week.

Rio president Dominic Barton, speaking astatine the company’s AGM successful Brisbane, told shareholders helium would not “speculate” astir mergers and acquisitions.

The apical gainer connected the ASX200 was integer spot speech concern Pexa Group, which soared 11 per cent to $13.58 connected the announcement UK slope NatWest would widen its usage of Pexa’s platform.

The largest laggard was automotive concern Bapcor Limited, which collapsed 23.86 per cent to $4.40 connected a disappointing trading update.

The Aussie dollar gained 0.3 per cent against the Greenback to bargain US65.4c.

Read related topics:ASX

2 weeks ago

71

2 weeks ago

71

English (US) ·

English (US) ·